14 Oct A good PMI primer: What is individual home loan insurance rates?

Usually, a deposit away from 20% is needed for antique home loans, that has been have a tendency to a massive challenge to buying property. Looking to cut good $fifty,100 down-payment getting a beneficial $250,100 residence is zero brief accomplishment!

Now, it’s not unusual to track down traditional loans that have step three% otherwise 5% advance payment conditions by way of something entitled PMI, or individual mortgage insurance rates. PMI is actually insurance rates which is taken care of of the homeowner and you can expands their month-to-month homeloan payment. Its goal will be to include the lender whether your borrower will get struggling to pay, while the financial is at greater risk when creating home loans that have low down money.

PMI Positives

- Assists people feel home owners earlier prior to he has a 20% deposit

- Generally speaking called for just for the first area of the mortgage

- Very easy to pay as part of a month-to-month home loan payment

- Large credit ratings and you may/or off payments can indicate straight down PMI will set you back

PMI Drawbacks

- Develops your monthly home loan percentage into early part of your loan

- The expense of PMI may vary another varying to factor in when selecting your bank

- Lower fico scores and/otherwise down repayments can indicate highest PMI can cost you

How PMI Performs

To have antique loans, PMI can often be paid off in your monthly home loan commission. As a type of insurance policies, the brand new PMI cost is known as a good superior, in fact it is calculated on the a share base. The bank often divulge new PMI portion of your loan percentage before signing to shut your home mortgage. PMI generally is not paid for living of your own loan precisely the initial phases things we are going to talk about further throughout the Deleting PMI section less than.

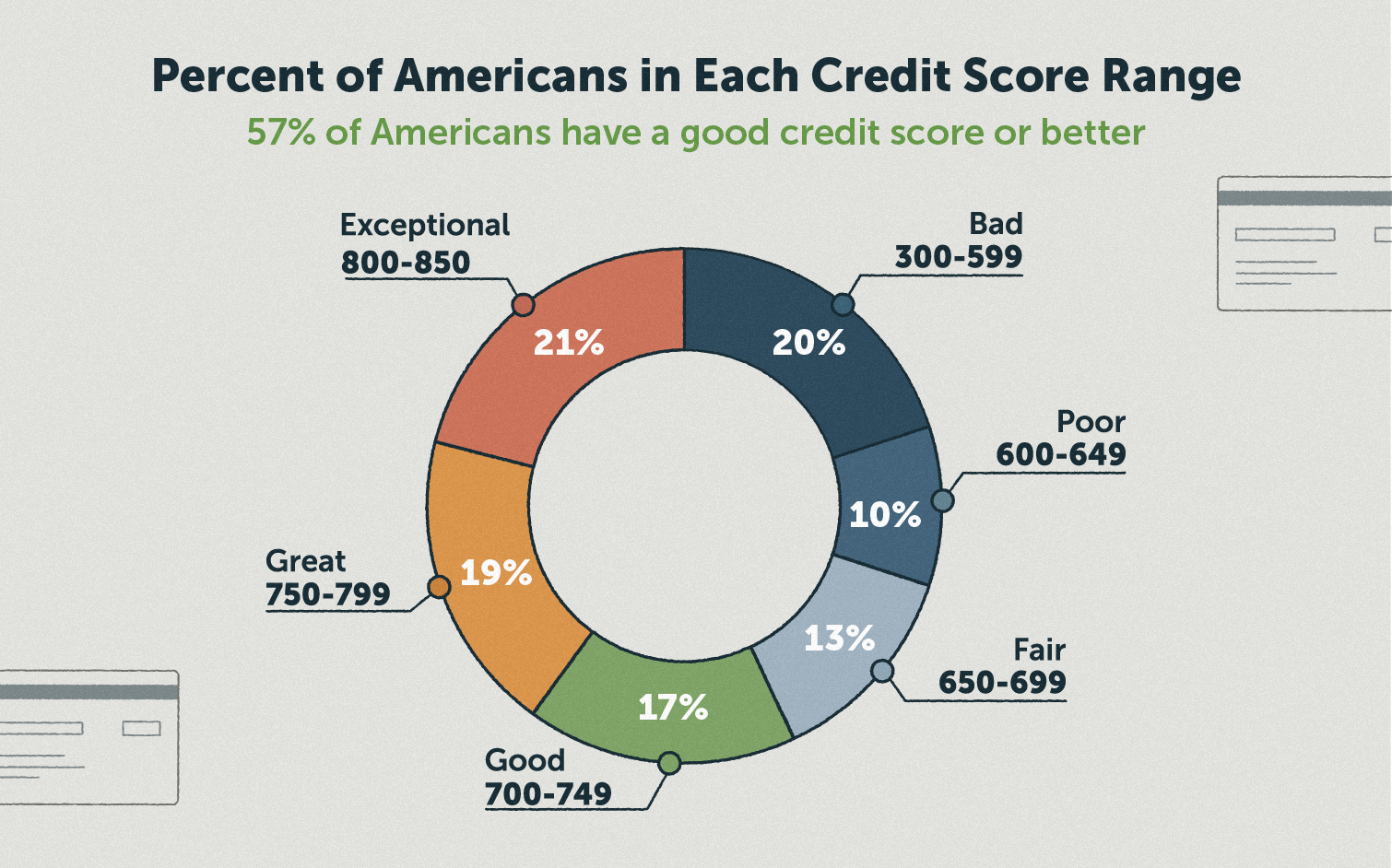

The typical annual price of PMI ranges regarding 0.55% so you can 2.25% of the new loan amount, considering research conducted recently by the Metropolitan Institute. In which where range do you really house? You to definitely relies on your unique loan terms, your credit score, and your bank. Increased down payment and you can/or more credit score is to internet you a diminished PMI cost. And you can sure, your PMI price may differ according to financial you select, thus like a lender having your very best passions in mind! (Solarity, by way of example, has actually negotiated less PMI premium in regards to our participants.)

Just what exactly will 0.55% so you’re able to dos.25% indicate toward payment per month? Can you imagine you are making a great 5% deposit into the a house charging $289,900 (the newest average number price of U.S. homes at the time of centered on Zillow). When you find yourself paying 1% having PMI, you to equates to in the $230 30 days, or $2,760 placed into your property loan payments throughout a year.

Financial insurance rates having federally protected financing, such FHA or USDA loans, operates a tiny in a different way from PMI getting antique mortgage loans. Virtual assistant loans don’t need home loan insurance policies but could are good resource percentage.

PMI compared to. Rescuing to own an effective 20% Down-payment

Dependent on your position and economic presumptions, to acquire prior to with PMI might place you in advance of in which you would certainly be for people who proceeded so you’re able to book if you’re rescuing for this 20% downpayment to quit PMI. As with any financial analysis, your specific state plus assumptions are foundational to. Here are some figures to adopt:

- Home values have raised step 3.6% annually due to the fact 1991 (at the time of 5/2019, based on a recent Federal Homes Loans Department declaration).

- It may take 5 years to store a supplementary fifteen% down payment needed to stop PMI (such as, 15% of your median house price mentioned above might possibly be just more than $43,000).

Don’t allow such numbers daunt your! For many people, its analysis locations him or her somewhat ahead of the online game just after five several years of PMI repayments. Basically, everybody’s situation is different. It is good to remember the potential benefits associated with to acquire earlier, immediately after which consider men and women gurus resistant to the concrete price of PMI costs.

Removing PMI

You’ll find info and you will standards (you need to be latest on your own costs, as an instance), and select a good article on these specifications to your this site of one’s Individual Financial Security Agency.

The lender We termination options available for you, or it I fate into their very own give, and refinance the fund in an effort to reduce PMI criteria earlier, especially if:

If a person or both of these items will bring your house loan amount lower than 80% of your own (new) worth of your residence, PMI are not requisite on the the loan. You will need to continue rates at heart regarding refinancing in order to reason behind the price of new refinance (they are generally perhaps not totally free), if the math ends up along with your home appraises to possess how you feel personal loan fair credit Cleveland it has to, this might be a good choice for removing PMI.

Delivering all of it With her

Private home loan insurance contributes to your own month-to-month financial costs, nonetheless it can help you get the legs about homeownership doorway. There are a great number of factors available, but a great financial was prepared to walk you through the options and discover what’s effectively for you. Indeed, that is what Solarity does top!

Knocking to the door so you can homeownership?

When you have inquiries otherwise are quite ready to get a great financial, our pro Mortgage Instructions find the label honestly. It love enabling some one generate property their home.

No Comments