15 Oct Appeal into the HELOCs is commonly eligible for a tax borrowing from the bank when utilized for qualified strategies

HELOCs constantly come with varying interest rates, however you might be able to safe a fixed interest in your a good harmony.

Home improvement (renovations) vs. family repairs

The difference between renovations otherwise home improvements and you will household fixes arrives right down to the idea. Property update was an upgrade or change to the home one improves their built-in well worth otherwise spirits. In contrast, fix ‘s the repairs out-of present formations to keep them in the operating buy.

Particularly, domestic solutions you’ll were repairing a leaky roof or repairing a keen Hvac program having situations. Renovations were significant improvements such as substitution your bathrooms, re-doing a cooking area, adding an expansion, or establishing a pool otherwise solar energy panels. A remodelling cover anything from repairs, although mission is over repairs; rather, it concentrates on refreshing or stimulating the home which have condition.

Tax-allowable home improvements

Particular renovations is generally entitled to taxation pros aside from the sort of financing you take out. Even although you fool around with a property equity loan for money, never assume all do-it-yourself strategies qualify for an income tax deduction. It is important to browse the Irs web site for most recent direction toward do it yourself deductions.

Even though it is essential to consult with a CPA or income tax elite group to confirm your own qualification, another tends to be income tax-allowable otherwise qualify for taxation credits.

1. Home business office deductions

For people who work at home and just have a faithful workspace, you may be in a position to deduct the fresh proportionate costs. That it just pertains to mind-functioning somebody otherwise advertisers. You simply can’t bring this deduction when you’re a member of staff of another company a home based job.

Remarkably, the expression home business office is broad. A boat, Rv, mobile house, unattached driveway, facility, if not barn you will be considered when it is strictly used for company. To help you be eligible for that it deduction, you must fulfill most other Irs requirements.

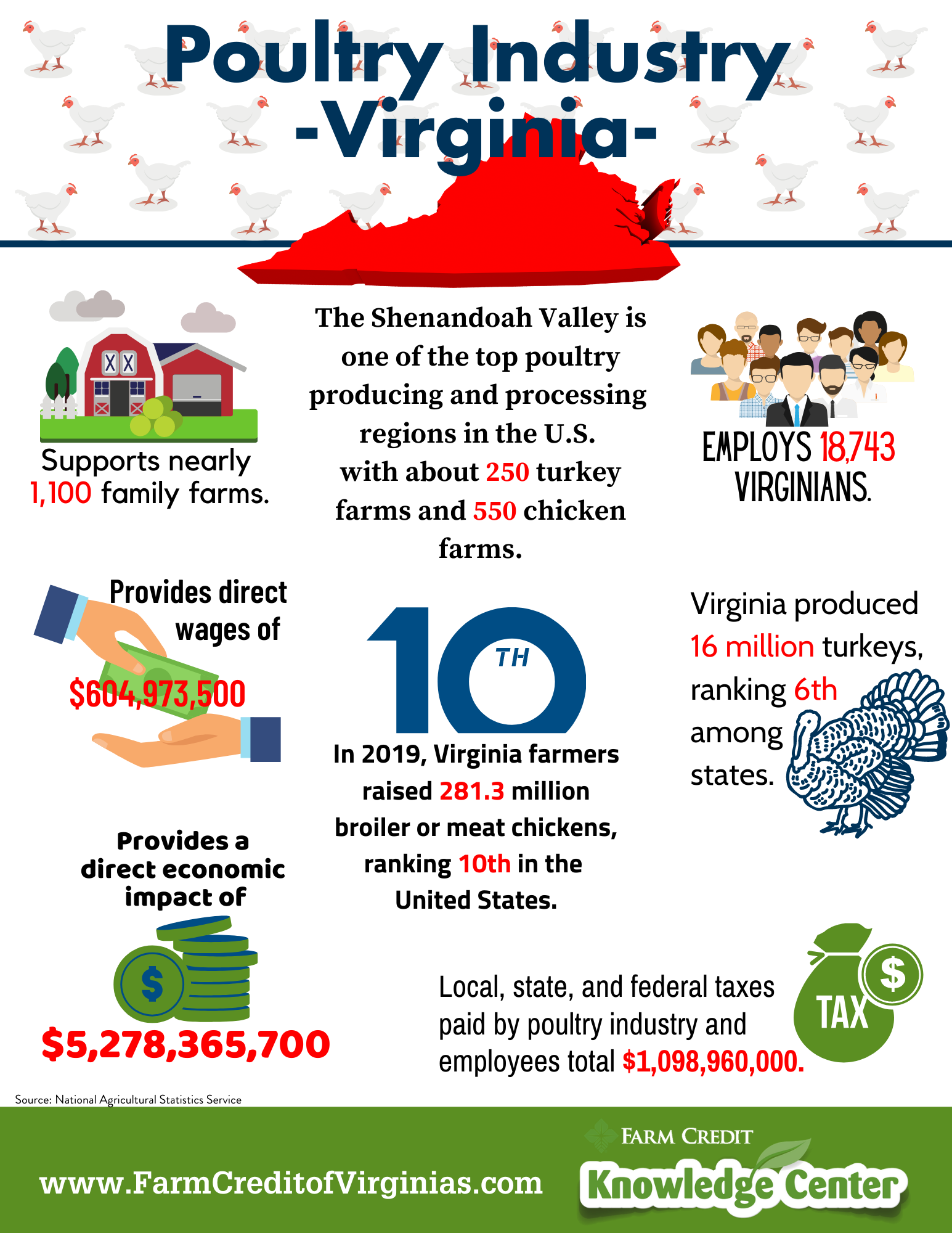

dos. Energy-efficient installation

Energy-successful gizmos instance temperature pumps, solar panels, energy-effective windows, biomass devices or short wind generators will get be eligible for a taxation break. You are able to rating a prospective credit to possess time-effective air conditioning or water heaters.

Brand new Home-based Clean Energy Possessions Borrowing from the bank relates to qualifying environmentally-amicable re also, and Jan. 1, 2033. You could be qualified to receive an income tax credit of up to 30% of one’s complete devices will set you back. Particular conditions differ because of the sort of products hung, and need give deductions over decade.

step 3. Medical-relevant home home improvements

Medical-relevant household home improvements is set up necessary for medical care to you, your spouse otherwise dependents. These home improvements normally do not increase the property value but they are medically necessarymon clinically-relevant home improvements were:

- Including ramps otherwise wheelchair raises

- Altering stairwells.

- Widening hallways and you will doorways.

- Creating wheelchair otherwise in another way-abled supply having restrooms, cooking area shelves, devices, electric channels, or official plumbing work solutions for someone with a handicap.

If you have generated these types of enhancements, it’s also possible to qualify for a taxation crack provided the improvements slide in this certain parameters. However, architectural otherwise aesthetic change and clinically called for renovations may not be considered allowable. Prior to home improvements, consult with an excellent CPA to know what are deductible.

Tax-deductible house fixes

Financial support improvements incorporate value to your residence, lengthen the existence or adjust it so you can the latest uses. Such developments is biggest loans in Log Lane Village home improvements such as

- Swimming pool

- A separate deck

- Storm windows

- An intercom program

- A security alarm

Financing advancements commonly deductible around you create all of them and you can rather are merely deductible from the pricing foundation once you offer the home. Keep clear records and you may talk to an income tax coach regarding the prices basis and you can any possible write-offs when you intend to offer.

No Comments