18 Oct Personal bank loan Qualification Calculator: Examine Qualification On the internet

A consumer loan eligibility calculator comes in helpful if you want a quick idea of as much mortgage you are qualified to receive. Unsecured loan comes with financing when lifetime requires an urgent turn otherwise when you really need a little extra fund to fulfill their desires and you can dreams. Whether believe a married relationship otherwise offering your property another interior, personal bank loan can also be convenience debt burden. Although not, checking all the packages on unsecured loan conditions is a must of getting your application approved. These conditions understand what matter will be sanctioned for your requirements.

Disclaimer

Axis Financial cannot verify reliability, completeness otherwise right sequence of any the details considering therein and you can thus no dependence are set because of the affiliate for your purpose at all into suggestions consisted of / investigation generated here or towards the their completeness / precision. Employing any recommendations establish is entirely from the Owner’s very own exposure. Member will be exercise due proper care and you may alerting (in addition to if required, acquiring regarding indicates out-of taxation/ legal/ accounting/ financial/ almost every other benefits) before you take of every choice, acting otherwise omitting to act, check these guys out in line with the information contains / study made herein. Axis Lender does not deal with people responsibility or obligation to help you posting any analysis. No-claim (if or not inside the package, tort (plus carelessness) or otherwise) should develop out-of or perhaps in contact with the support against Axis Lender. Neither Axis Financial nor any of their agents otherwise licensors otherwise group enterprises shall be liable to representative/ people alternative party, the lead, indirect, incidental, special or consequential loss or problems (plus, without restriction to possess death of profit, business opportunity or death of goodwill) anyway, if or not in price, tort, misrepresentation or else due to using these tools/ pointers contains / study generated herein.

What exactly is a consumer loan eligibility calculator?

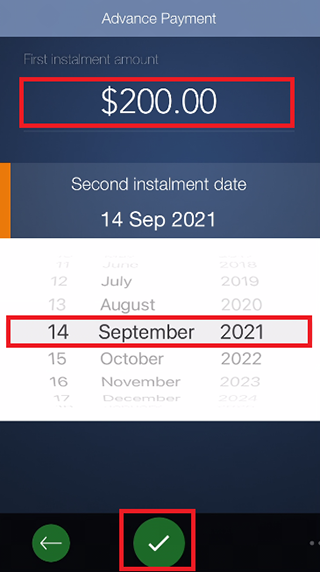

A personal loan qualification calculator is actually a tool that can help your examine personal loan qualification and assess the restriction amount borrowed you is also be eligible for centered on parameters like your net gain, years, and you can most recent debts and a great payments. So it unsecured loan qualifications checker saves your time which have a fast analysis, along with info to make the best decision for oneself. Everything you need to perform is actually complete the facts during the the internet calculator, along with an idea of the level of mortgage your are eligible getting, to go-ahead properly. Look at your bank’s financing eligibility requirements before you apply and you will compare your own choices for a consumer loan, and make advised economic decisions and you can easing the borrowed funds software process for oneself.

Exactly how are personal loan qualifications determined?

Your financial personal bank loan eligibility is computed after a detailed assessment of the websites monthly money and you may existing obligations, plus EMIs, years, place, credit history, and other conditions very important to qualification. So it evaluation helps generate openness ranging from your bank and you will prevents one miscommunications regarding the credit and you may borrowing procedure.

Which are the requirements private mortgage qualification?

AgeYou must be about 21 years old after you sign up for the loan, therefore the restriction age at maturity from personal loan period, is 60 decades.

Lowest academic qualificationHaving a graduation degree beneath your name’s preferable. However, it is not a prerequisite in order to be eligible for the private loan acceptance processes.

Minimum monthly incomeThe minimal websites monthly earnings for the metropolitan areas particularly Delhi and you may Mumbai is sometimes Rs. twenty five,000, however, almost every other cities could have a qualifications requirement of Rs. fifteen,000. It varies from one lender to a different as well.

Functions experienceA lowest works exposure to one year is expected to help you be sure that employability position and cost capability to the lending company.

What items apply to personal loan eligibility?

AgeThe minimum age is actually 21, you cannot apply before you to, even though you fit most other conditions. Similarly, you are not qualified to receive a beneficial five-season mortgage from the sixty years of age.

Borrowing scoreA credit history out of 720 otherwise above is recommended in the event the we want to be eligible for an expected amount borrowed. One thing lower than which could decrease your likelihood of providing a good personal bank loan.

Lowest month-to-month incomeIf you really have a month-to-month earnings less than Rs. fifteen,000, according to your local area, it can be hard to see an unsecured loan.

Functions experienceYou commonly qualified to receive a personal loan if you don’t has 1 year out of really works experience with a similar organisation.

Debt-to-money ratioYour debt-to-earnings proportion would be to essentially getting below forty% of your net monthly income, and this develops your chances of recognition and you will more substantial financing sanction count.

What data do you wish to finish the unsecured loan software techniques?It’s possible to get Personal bank loan, digitally, no files, through Axis Bank. not, you can need the below in the event of offline application.

- A filled-out and finalized application for the loan mode which have an excellent passport-dimensions photos.

- KYC files (Aadhaar credit, passport, driver’s permit, or voter ID)

- Age research (Aadhaar card, passport, driver’s permit, delivery certificate, school leaving certification, or Pan card)

- Signature evidence (passport, Pan card, otherwise banker’s verification)

- One-seasons a job facts

- Income sneak on earlier 90 days.

- Financial statement regarding earlier 6 months.

No Comments