10 Nov 5 exactly what you need to learn about refinancing so you can redesign

Refinancing is essentially substitution their dated home loan with a brand new that. This doesn’t mean your debt was deleted (we want!) you could plan the loan toward a better contract to meet your current means. If you have currently ordered a home and are generally settling a beneficial home loan, your upcoming big purchase – such as for instance a different automobile or a renovation – also have a knowledgeable opportunity to feedback your finances and make certain you’ll get the best offer.

Refinancing helps you benefit from the new home loan and you may credit activities, of lower rates of interest to significantly more customised have.

I talked on the pros in the Newcastle Permanent Strengthening Neighborhood so you can get some good straight-firing, customer-centered advice about funding their restoration.

step one. Why would We refinance just before renovating?

Remodeling can rates 10s or thousands of bucks, for example you’ll be able to most likely must processor chip to your present financial or take away a different sort of loan to purchase cost. Refinancing immediately form you can aquire the cash expected from the a much better speed.

Its a sensible way to obtain the most finance you want doing your own home improvements within a cheaper rate of interest than say an unsecured loan, Newcastle Permanent lead from customer financing Greg Hooper says.

Together with, users might be able to make use of a great deal more competitive rates than they are toward employing current standard bank. Along with, [they might] make use of cashback has the benefit of which may use when refinancing.

2. What’s employed in refinancing?

Refinancing is not as challenging because you can imagine and will feel similar to any application for the loan – otherwise probably quicker very.

Step one is to perform a little research and make contact with certain legitimate lenders who can inform you your best strategy. Newcastle Permanent try has just granted Greatest Bank in australia from the Forbes mag and is a buyers-possessed shared bank, definition it generally does not solution to shareholders. With users leading the way, capable answr fully your inquiries in order to select what exactly is most readily useful to suit your private finances.

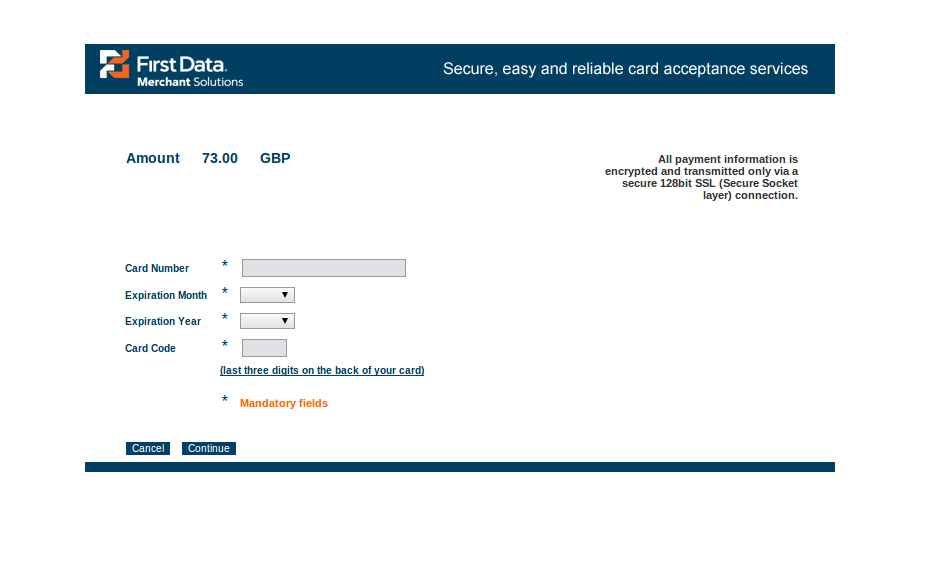

You will find punctual recovery moments of entry regarding app in order to consequences out of basically 24 so you can 48 business hours, Hooper claims. The whole procedure regarding app to help you payment will likely be normally between 2-3 weeks.

step three. Can i merge the my personal profit which have one financial?

Not always, but choosing you to lender for your home mortgage and financial is fundamentally a whole lot more straightforward as it simplifies your money so there try often incentives to do this.

If you have all financing having that place, it can make it simpler and much easier to help you acquire a lot more finance with the equity on the property, Hooper means.

Making use of the collateral on the property to pay for biggest commands, such as for instance cars, caravans, home improvements and stuff like that, will most likely suggest a diminished rates than a personal bank loan.

You will additionally feel the you to credit director that will help you with debt means in you to definitely roof, that can renders something far easier and much easier to have consumers.

cuatro. Exactly what are some loan has actually to look out for?

Whenever renovating, you can easily probably need a loan merchandise that enables you to availableness funds easily and quickly to pay-all people builders, tradespeople, services and stuff like that.

Offset and you may redraw facilities are good unit features whenever remodeling, Hooper demonstrates to you. This gives you the benefit of spending less to your interest during this time around. Each one of these has actually is going to be regarding your internet banking, therefore it is an easy task to flow the money to ranging from account and you will to spend new expense.

The guy adds that you’ll want to speak with their lender in advance of and after the recovery to ascertain hence selection might be best to your requirements and you will budget.

5. Do folks have to refinance whenever renovating?

Not. There are many avenues when deciding to take and also the correct one have a tendency to count on your own personal earnings. There is certainly costs with it, and additionally split will set you https://elitecashadvance.com/loans/school-loans-for-bad-credit back when you have a predetermined rates mortgage, it depends as much as possible reap the future advantages of step.

When refinancing with purpose to help you renovate, it is critical to keep in mind your loan so you can really worth proportion (LVR), Hooper states.

Loan providers Financial Insurance coverage (LMI) may incorporate and is also beneficial to avoid that where you can easily, and take the other costs into account. Might must also ensure your brand new financial is able to facilitate the rise during the a lot more funds hence your income is sufficient to be considered.

If you can reach your mission together with your newest bank and youre proud of their sense then you definitely possibly won’t re-finance.

Having said that, the aim is to get the very best package to you personally economically whenever taking up a new tall financial weight – like a repair – refinancing helps make enough feel long-term. Better talk to particular trusted financial institutions to find out what is actually best for you.

No Comments