16 Oct Stating Numerous Revenues Whenever Trying to get an interest rate

That have multiple efforts is normal these days, but loan providers have some guidelines with regards to income that qualifies to be used getting a home loan. Lenders undertake most money offer that people typically have, but exactly how they determine they, and what records they’ll you would like may differ based on the supply, duration, and you can level of money.

Money Must https://paydayloanalabama.com/fayette/ be Steady

- New surface of one’s income

- The length of time the funds has been obtained because of the borrower

- The chance your money is going to continue later on

Such factors are easier to determine having certain revenue than the others. Information on how mortgage lenders check some types of earnings:

A position Earnings

This is money acquired using paycheck otherwise earnings when employed by someone else. Lenders generally confirm that it income owing to a variety of previous pay stubs, W-2s, and you may authored otherwise verbal verification out-of employment from your employer. Additionally, the lender will additionally be seeking to guarantee your job name, length of a job, and exactly how likely its to suit your a job to keep.

Loan providers have a tendency to generally speaking find a-two-year work records, although shorter are acceptable whenever you are fresh to the latest staff.

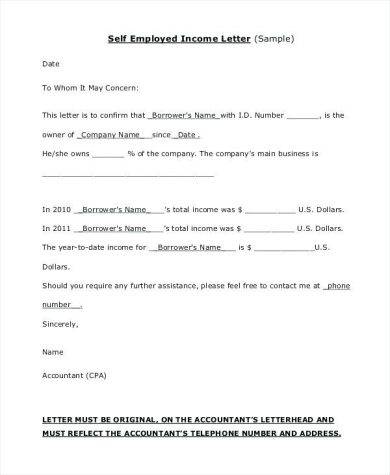

Self-A career Earnings

To possess notice-a career, lenders normally need that you’ve been doing this for at least couple of years. Confirmation arrives thru duplicates of cash taxation statements and sometimes needs a duplicate out of a business license or verification of one’s size of your notice-a career together with your CPA.

Money will normally become averaged across the newest two years, and you will customizations might be made eg incorporating back depreciation expense, since it is maybe not a genuine dollars expense.

Your lender might be seeking a pattern out of stable otherwise growing income throughout the years. If for example the earnings from inside the season several is marginally lower than you to definitely of year one to, the financial ount. If the mortgage is recognized as risky due to considerably declining earnings, you do not getting qualified at all.

Local rental Income

As with other incomes, your own lender have a tendency to generally you want two-years of records to utilize leasing earnings. This really is your own net gain, the disgusting book, with no expenses regarding getting the home. Just as in mind-employment, non-bucks costs like depreciation would-be extra back.

When there is a loss on your own rental properties, one shortfall would-be calculated every month and you can additional for the long-term financial obligation so you’re able to determine the debt-to-money rates.

Funding Money

The rules for using money earnings are now and again much more perplexing than simply along with other money designs. Lenders generally speaking need to have the following the to look at funding earnings:

- A two-year history of getting financial support money

- A good investment house collection adequate to secure the claimed income

- Tax returns regarding early in the day couple of years, and you may economic comments exhibiting the worth of the investment.

Second Earnings Supply

When it comes to an associate-time employment, your lender usually generally take a look at a two-year records for which you kept each other the complete-day updates as well as your 2nd work. They will average your income over the past couple of years, backed by pay stubs and W-2s.

Top businesses are felt like full-date mind-a career. The lender wants to ensure which you have managed an excellent side team that was effective for around the last 2 years. You might be needed to make taxation statements filled with Schedule C, confirming your revenue.

While you are making an application for home financing, it is wise to volunteer people money offer which you have. Your lender will let you know if it is acceptable for degree, and will take you step-by-step through the new tips from verifying the income.

We know that financing a property would be a daunting task, but the experts only at Butler Financial are here to greatly help. Our Financing Officials will perform everything you can and make the home loan sense because the painless as possible, in order to spend less big date alarming, and a lot more date watching your house. E mail us now at 407-931-3800 that have questions.

No Comments