18 Oct Lenders offering Virtual assistant funds require that you render a certification off eligibility (COE)

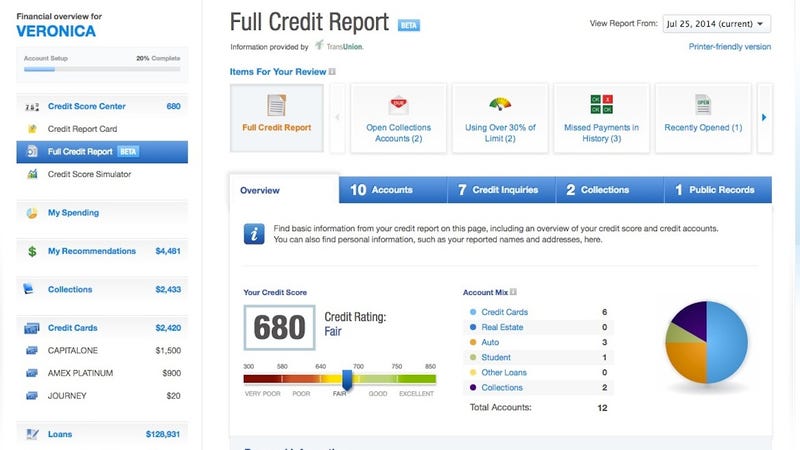

This falls out white on the in case your Virtual assistant entitlement could help be eligible for a beneficial Va financing. While most loan providers one to bargain within the Va loans select borrowing from the bank many 620 or more, some are willing to provide these types of finance to help you candidates having credit countless more than 500.

Their DTI ratio is always to if at all possible be no more than 41%, even though there are conditions to own candidates who’ve highest recurring earnings. Additionally, it is necessary for your not to have defaulted into people kind of government obligations in the past.

Traditional Mortgage loans

Although some someone use the terms old-fashioned mortgage loans and you can conforming mortgages interchangeably, they may not be a comparable, whilst the eligibility requirements is mostly similar.

What kits a conforming financial aside from one that’s maybe not was the previous needs to adhere to small print one meet the requirements place of the Federal national mortgage association/Freddie Mac computer, mainly with regards to the maximum financing amounts. From inside the 2023, the upper limit to have single-product services located in large-costs elements try $1,089,3 hundred, which restrict try subject to changes every year.

Very company out-of old-fashioned mortgages need consumers to own credit ratings from 620 or more. They also get a hold of DTIs less than 43%, although this matter can be also all the way down for those who have mediocre creditworthiness.

Mortgage Proportions

The maximum you may want to borrow compliment of whichever mortgage would depend on your own earnings, assets, and credit rating. However, you may also feel at the mercy of specific constraints according to the brand of mortgage you need to get.

USDA Funds

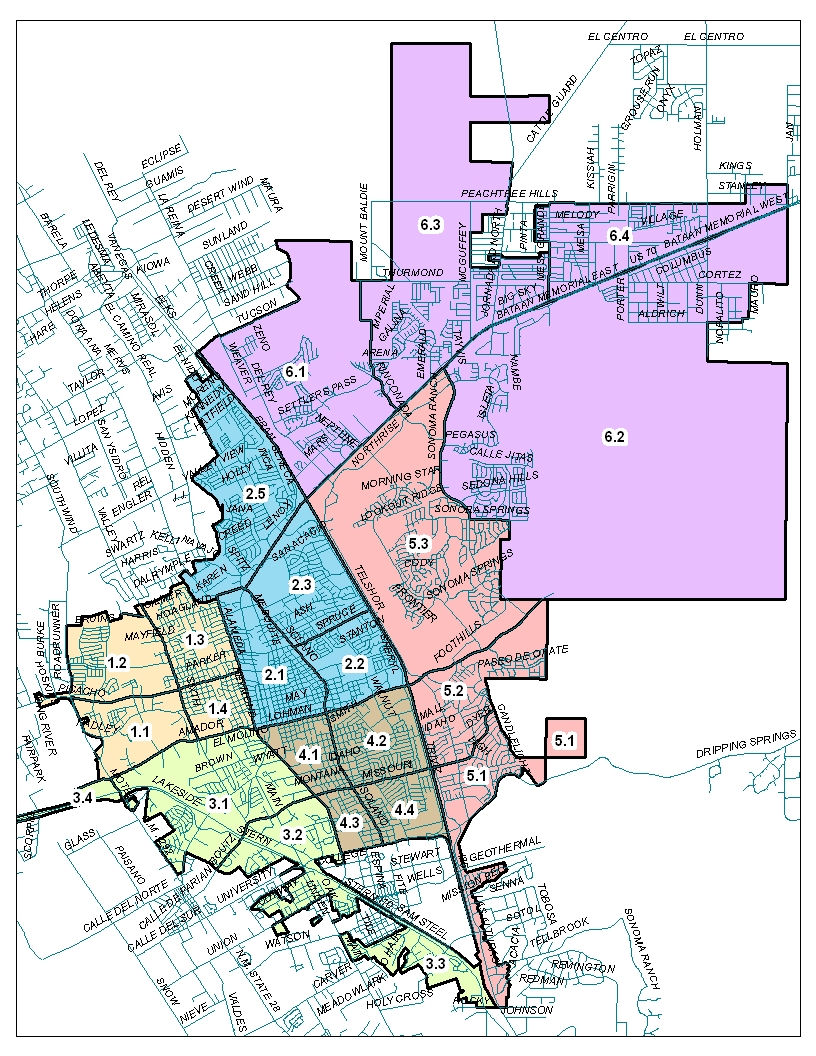

USDA loans feature area financing limits that may are very different created with the state in which any given house is discover. Like, it restrict really stands within $377,600 for almost all qualified counties round the Ny (therefore the other countries in the nation). not, it transform to help you $581,2 hundred to have Orange County and to $871,400 for Putnam County.

Virtual assistant Funds

Just like the 2020, qualified experts, existing provider members, and survivors who have full entitlement don’t have to value the latest $144,000 limit Va mortgage limitation . You get full entitlement by the appointment some of these loans in Morrison Crossroads standards:

- You have never made use of your Virtual assistant financial work with.

- You’ve reduced a previous Va mortgage entirely and offered our home.

- When you’re you used their Va financial work for, you’re working in a damage allege otherwise a property foreclosure and you will paid down the loan totally.

If you have leftover entitlement, you might use they to find a different sort of Va mortgage, although you are following subject to brand new state-certain financing limitations that use towards the conforming loans.

Traditional Loans

If you plan buying one-tool domestic by getting a compliant loan supported by Fannie mae or Freddie Mac computer, you will want to account for compliant mortgage restrictions (CLLs) . In the most common counties across the You.S., it limitation really stands during the $726,200 inside 2023, upwards of $647,2 hundred into the 2022. In some large-pricing areas, that it count develops to help you $step 1,089,three hundred.

When you get a low-conforming old-fashioned loan, the most it is possible to acquire hinges on the financial institution you choose. Some lenders render jumbo funds all the way to $2 mil, even though they generally require individuals having expert fico scores and you can generate high off money.

New Down payment

The USDA versus. Va financing testing really stands from the harmony with respect to down payment due to the fact each other have an excellent 0% down payment requisite. It means you may get each one in place of and make one down commission.

Regarding antique mortgages, first-date homeowners can get spend as little as step 3% for the down-payment, although this depends on the income and you may creditworthiness. People who find themselves to buy its next belongings otherwise secure less than 80% of the area’s average income may prefer to shell out 5% to 10%. If you intend to get a property that is not a single unit, you may have to pay at the very least fifteen%.

No Comments