21 Oct Good development in FHLB insurance carrier registration and you will borrowings

Limitation credit constraints to have enhances are different of the FHLBank, but are not slide ranging from 20% and you will 60% regarding total property. User enhances pricing fixed or floating prices round the an effective listing of maturities, off right-away to help you thirty years. According to the newest FHLBank Workplace off Financing investor demonstration, floating-rates enhances happened to be simply over 29% out-of total enhances since . New readiness of enhances has actually shortened in tandem using this development to your a floating rates: Over 90% out-of improves decrease inside the smaller-than-you to definitely four-12 months diversity by the end of 2023, a twenty five% raise more than 2021. Whenever you are rates are regularly up-to-date and you will disagree all over banking institutions, Contour 1 directories a sampling away from prices at the time of .

Figure step 1

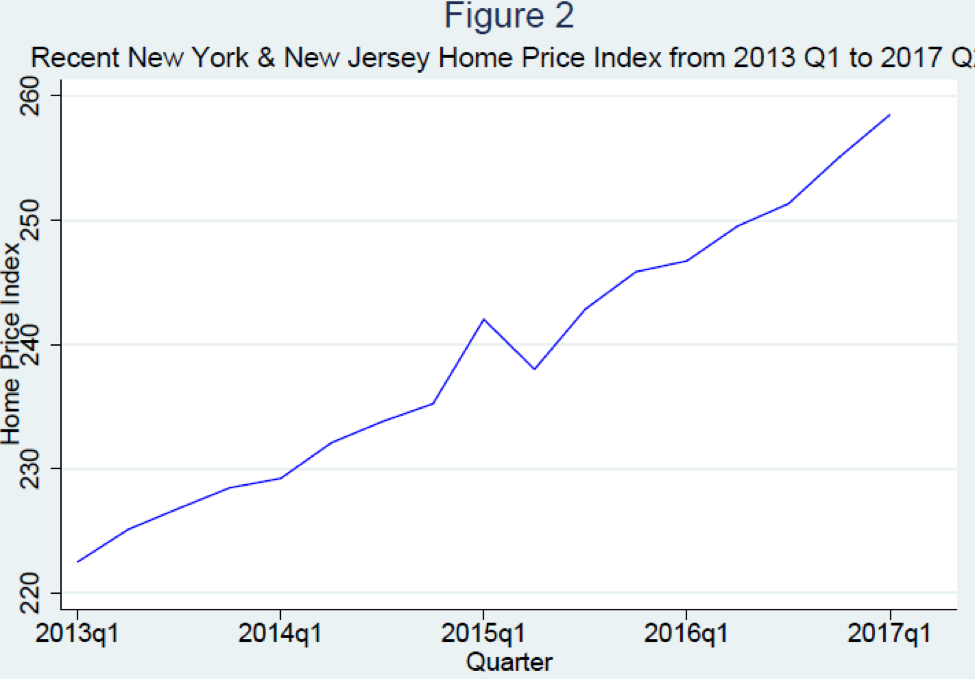

So you can capitalize enhances, consumers have to buy passion-mainly based FHLB stock plus the stockholdings required for membership. The fresh new FHLBank Workplace regarding Fund cites a typical rate from 4% 5% regarding dominant lent. Both subscription and you may activity-oriented inventory versions bring dividends. This money might be returned to this new affiliate through stock buyback since improve was paid back. Advances are also expected to be fully collateralized of the ties or loans; particular requirements for such as equity differ by the local FHLBank and also the potential borrower’s credit status. Generally speaking, qualified collateral have to be unmarried-A placed otherwise above and houses-relevant. This might were: United states Treasuries, company obligations, department and you may non-department MBS, commercial MBS, municipal bonds (having proof these was casing-related), cash, deposits when you look at the a keen FHLBank, or any other real-estate-relevant property. Extremely, if not completely, insurance companies generally already very own each one of these qualified guarantee brands. Business securities, individual obligations, and you may equities commonly approved since the collateral. The new haircuts placed on collateral are different because of the financial and by member-applicant (Figure 2).

Figure dos

FHLBanks can provide really aggressive interest levels compared to commercial loan providers, and you can recognition associated with the subscription work with continues to grow one of insurers. Year-over-year growth of insurance carrier subscription in the FHLB program could have been constantly self-confident over the past 25 years. A total of 68 the newest insurers joined the brand new FHLB inside 2015, a historic higher. Subsequently, the latest FHLB system features benefited out-of normally twenty-six the brand new insurance-providers users per year.

This type of players is actually taking advantage of glamorous borrowing from the bank conditions: Advances in order to insurance policies-company members hit an all-day a lot of alongside Us$150 million in the 1st quarter off 2024. Inside the a survey in our insurance policies members on their FHLB advances,8 participants cited many purposes for the money, along with unexploited disaster exchangeability, effective liquidity give enhancement expenses, resource and you may accountability management (ALM) requires, buy resource, and you may refinancing out of 144a loans.

So much more generally, subscription by insurance companies became within a yearly pace out-of eight% in the period of 2013 from earliest one-fourth away from 2024. The latest percent from complete face value away from insurance company advances rose 8% a-year along the same several months, based on investigation about FHLB Work environment out-of Financing accounts. As of the first quarter out of 2024, insurance firms got lent 19% regarding full a great FHLB enhances, or Us$147 million. Improves was indeed stretched so you’re able to 235 collection of associate borrowers regarding 580 overall FHLB insurance policies participants (look for Figure 3). One of many center experts given that a keen FHLB debtor is actually availableness to help you liquidity in a situation of field worry. The newest sharp miss in the per cent show out of overall face value out-of improves pulled of the insurance firms reflects a thirty% boost in pop over to this web-site borrowing from the bank of the industrial banking institutions year more than seasons plus in tandem to the fret thought on banking community throughout the spring of 2023 (select Profile step three). Brand new shift into the borrowing regularity portrays the FHLB system supports besides its members’ providers means, in addition to that from new greater financing areas.

No Comments